Endowus vs Syfe

Credit: Aidan Hancock

Have you ever wondered how to start investing? You would most likely have heard of terms like stocks, ETF, unit trusts, etc. You might even wonder if you should invest with an agent or through a Robo-advisor. Like you, it took me some time to learn about all these investment terms. I had invested a small sum in both Endowus and Syfe. I will write a review about both applications in this post.

Disclaimer

This post is not a sponsored review. I am not a financial advisor. The information on this post does not constitute financial advice.

I strongly advise that you read up on investment and the two platforms before you start to invest. Please do not make any decision solely on this blog post. It is always better to get a second opinion and maybe seek professional advice.

Both the Robo-advisors’ websites are constantly being updated. Check out their websites and products for more information.

1. What are Endowus and Syfe?

There are Robo-advisors available in Singapore, and that includes Endowus and Syfe. You can invest your money with either of the platforms.

2. Investment Portfolios

Endowus

Endowus provides the following portfolio:

General Investing

Cash Smart

Fund Smart

Source: Endowus

We will cover Cash Smart in the next segment. Let us focus on the investment portfolios.

1. General Investing

Under General Investing, you could choose to invest in either Core or Environmental, Social and Governance (ESG) portfolio. You can grow your wealth in the globally diversified funds under the Core portfolio. Alternatively, if you read about the United Nations 2030 Sustainable Development Agenda and are interested in sustainable investments, you could invest in ESG.

Source: Endowus

2. Fund Smart

You can create your portfolio by choosing from the list of funds. I like this Fund Smart portfolio because you can easily invest in S&P 500 by choosing Lion Global Infinity US 500 Stock Index Fund. The Lion Global Infinity US 500 Stock Index Fund replicates the S&P 500 Index as closely as possible. Hence, Fund Smart is a good alternative for investors who do not wish to go through the hassle of dealing with the brokerage and administrative details but wish to invest in the S&P 500.

Source: Endowus

You can choose to invest in a single fund or a few funds and set the allocation.

Source: Endowus

Whenever you create a new goal, the app will request that you will fill in some details. Generally, you would need to declare how much risk you wish to take. Endowus will then personalise a portfolio accordingly to your risk appetite. For the Fund Smart portfolio, the app will prompt if the portfolio is within your risk tolerance.

Source: Endowus

Syfe

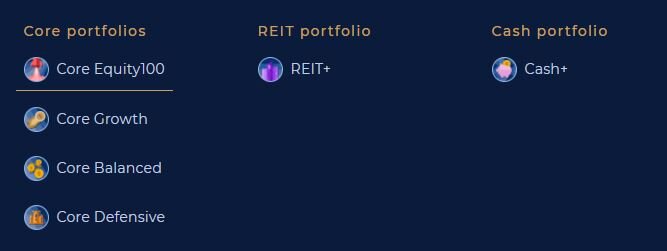

Syfe has three portfolios:

Core

REIT

Cash

Source: Syfe

We will focus on Cash+ in the next point.

1. Core Portfolios

A. Core Equity100 is 100% allocated to global equities. The portfolio holds equity ETFs which collectively invest in over 3,500 stocks of the world’s top companies.

B. Core Growth consist of Equity, Gold and Bonds.

Source: Syfe

For more info, please refer to https://www.syfe.com/core-growth.

C. Core Balance consist of a different percentage of Equity, Gold and Bonds.

Source: Syfe;

For more info, please refer to https://www.syfe.com/core-balanced.

D. Core Defensive consist of a high percentage in Bonds followed by Equity then Gold.

Source: Syfe

For more info, please refer to https://www.syfe.com/core-defensive.

Syfe has simplified the process for you. However, I would not encourage you to only look at the projected return, do consider your risk appetite. If you can manage the risk, go for Equity100. If not, you can opt for the Core Defensive. It is ultimately your choice.

On a side note, if you are wondering what bonds and equities are? Here is a summary of each of them:

A bond is a fixed income investment in which an investor loans money to an entity for a fixed period. The bond issuers will need to pay the money back to the investor.

Equities are also known as "stocks". When you buy a stock, you own a fractional portion of the company.

2. REIT+

A real estate investment trust (REIT) is a company that owns, operates, or finances income-generating real estate. In the local context, think Captialand, Mapletree, etc. There are two options available in Syfe. You could choose between 100% REITs or REITs with Risk Management. Syfe REITs with Risk Management would consist of Bonds and Cash.

Similar to Endowus, you can choose a portfolio that suits your risk level. You can invest 100% in equities, REITs, or include bonds in your portfolio.

3. Cash Management Portfolios

Endowus

The cash management portfolio is something like a bank account, but it comes with a better return. You can choose to deposit your money here rather than in the bank. However, it is an investment plan, albeit a low risk one. Endowus advised that you manage your cash based on when you need to use it.

Source: Endowus

Endowus Cash Smart Core is for the cash that you need in the upcoming days or weeks.

Endowus Cash Smart Enhanced is for the cash you need beyond a month.

Endowus Cash Smart Ultra is for the cash you need beyond three months.

In the following images, you would be able to view the underlying funds for each portfolio. I invested in both Enhanced and Ultra.

Source: Endowus Syfe

Cash+ is a cash management portfolio by Syfe, with a projected return of 1.5% per annum.

Source: Syfe

It consists of the following funds.

Source: Syfe

Both Endowus and Syfe provides Cash Management Portfolios. There are similarities in their funds. Regardless of which Robo-advisers you choose, either party projects better rates than your saving account interest rates. However, you might want to note that these portfolios are also a form of investment. It will involve some degree of risk. It is also not a guarantee that you would earn the exact percentage that the applications have foreseen.

4. Funds and Fees

| Endowus | Syfe | |

|---|---|---|

| You can invest with | Cash, SRS and CPF | Cash only |

| What is the minimum investment amount? | The initial investment amount is $1000. For subsequent transactions, you need to invest at least $100 each time. | You can invest any amount you like. |

| Fees (Investment) | Cash: 0.25-06% SRS and CPF: 0.4% Fund Smart Single Portfolio: 0.3% |

0.4-0.65% | Fees (Cash Management) | 0.05% | 0% |

5. Is it easy to invest with either of the applications?

Yes. You can make payment via PayNow or set up a recurring investment for both platforms. The instructions are easy to follow. It is straight to the point.

6. Conclusion

I invested with both Robo Advisors. I invest in Endowus partly because of the Fund Smart option, while I invested in Syfe REITs portfolio. I have a cash management portfolio with Endowus too. Hence, my investment strategy may be different from yours. Both Robo-advisors have different portfolios for different kinds of investing needs. You can choose to invest in one or both of them. You may want to ask yourself the following questions when you are choosing between the two platforms.

How much could you invest? Could you afford the initial sum of investment?

Are you investing with CPF, SRS or cash?

Are you comfortable with the investment portfolio?

Are you willing to pay the fees?

Hence, depending on your lifestyle and investment needs, you can…

1. Choose Syfe if you have a lower investment amount.

If you cannot commit an initial investment account of $1000, you can invest with Syfe. Moreover, there is no cap to how much you can invest per month too. You can choose to invest $50 every month. Syfe is an option for students who want wishes to start their investment early.

2. Choose Endowus if you want to invest with your Cash, SRS and CPF.

So far, Endowus is the only platform that I know that allows you to invest using your CPF and SRS. If you are looking to grow your CPF and SRS accounts, you can consider using Endowus. Also, if you would like to select which funds to invest in, you can choose Endowus.

7. Referrals

Endowus

When you invest with Endowus using the following link, you get $20 in Access Fee credit.

https://endowus.com/invite?code=LPGKH

Syfe

You can use my referral code - SRPRF7XNC - when you sign up for an account with Syfe. You would receive a six months fee waiver on your first S$30,000 investment.

Of course, you can choose not to use any of the referral links or codes and sign up with the company directly.

I hope this article is helpful.

x, Esther

Latest Review:

PS: I wrote and scheduled this article before Syfe Select was introduced.

Recently, Syfe introduced Syfe Select. It consists of investment themes such as ESG and Clean Energy, Disruptive Technology, etc. Like Endowus, Syfe now allows you to customise your portfolio too. I did not read up or explore these options yet. Hence, I did not review Syfe Select in this post.

I welcome suggestions and collaboration. Feel free to drop me a note at hello.estherp@gmail.com.